Today, I am writing about one of the three essential things of human life: Home Sweet Home.

Whether a person is a newcomer or already a Canadian citizen, everyone desires to own a house. It is far more expensive to buy a house in big cities like Toronto/GTA, and considering the importance of fulfilling the dream of owning a property, I am sharing detailed information regarding what might be helpful for many to take the right decision.

First, you must make up your mind to own your house as soon as possible; believe it or not, it could prove to be one of the wisest decisions taken, especially in Canada. Some people might fear taking big mortgage liabilities, which span anywhere between 20 to 25 years, especially in a country where job security is ostensibly not widespread, but unarguably, in Canada, real estate is the only industry which can fetch you higher and faster returns. To create wealth, you need to build up your equity, and renting will not help you build your equity; the humongous monthly rent you pay goes in thin air, whereas in monthly mortgage repayments, you’re paying a larger portion of the principal amount and creating equity gradually.

One of the other important reasons to buy a house as soon as possible is to have a peaceful retirement. Mostly, all newcomers with permanent resident status fall in the age bracket of 25-35 years and students between 18-30 years. Even if you buy your house at age 35, you will end up paying your mortgage up until 60 years of age (maybe earlier if you pay extra monthly money). Hence, the earlier, the better.

Now that you have made up your mind, the first question that arises is:

Do you qualify for the Mortgage?

For mortgage qualification, the first and foremost is your work profile; it’s way easier if one has a permanent full-time job or should have been working on a contract for more than 18 months. The important point to be noted here is that for a self-employed person or a new entrepreneur, most of the top Canadian banks are wary of giving a mortgage unless one could prove that they have an established profitable business for more than 3 years with year on year improving profit track record as well as the industry of business qualifies to be a stable one.

Roughly in a family setup, if both partners work on a permanent job, they could be eligible for 4.5 to 5.0 times their annual combined family income. Another point to be noted here is that different banks count different things as income; for example, some banks consider your childcare benefit a source of income. Ask your mortgage advisor this question; your realtor could most likely introduce you to one. Get a basic idea of how much mortgage loan you could obtain based on your current income, credit score and down payment availability. It will help you identify your budget and help you start hunting for a property in that range.

The next important question is the Down payment! An average 3-bedroom townhouse in GTA could cost anywhere between $600,000 to $700,000, a semi-detached house $700,000 + and a detached house $800,000+. To own a $700,000 house, you need a 20% down payment of $140,000. If you cannot afford it, then you may go for a lower down payment, like 10%.

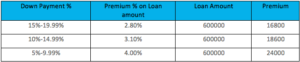

Anything less than a 20% down payment will incur insurance costs provided by a third-party CMHC (Canadian Mortgage & Housing Corporation). Please refer to the below-given chart for premiums based on the loan amount.

Source: https://www.cmhc-schl.gc.ca/en/finance-and-investing/mortgage-loan-insurance/mortgage-loan-insurance-homeownership-programs/premium-information-for-homeowner-and-small-rental-loans.

Another very important aspect to qualify for a mortgage loan is the credit score. To build up your credit score, start using a credit card from the day you land in Canada and always pay back the full amount outstanding on your credit card every month. It is better to have an unsecured credit card, too; you could get these from any retail store like Walmart or Canadian Tire, which will certainly help to better your credit score. Use credit cards wisely and do not overspend (read ‘exhaust the limit’); otherwise, it can reversely affect your score; in any case, if you pay the minimum bill, you get charged with massive interest.

Limit yourself to get your credit score checked. More than 5 hits will affect your credit adversely, so limit yourself to buying mobiles on 2-year contracts and always ask while buying anything whether any purchase will hard-hit your credit score.

Places to always ask whether a credit hit is required:

- Opening a Bank account (you can deny for a credit check for a personal account but for a business account it’s compulsory)

- When you register to buy a credit card.

- Cell Phone on contract

- Easy Finance while purchasing any appliances/camera/furniture, or other goods.

- When you buy a Car on Finance.

Once you are qualified for a mortgage, what’s next?

Should I be taking the services of a real estate agent to buy a house or not?

My suggestion is a definite YES, but before you officially sign up with any real estate agent, be sure to look for an agent who speaks your language and knows well about your culture and the kind of taste you could have for a house. Changing your agent once you sign up with someone on paper is very difficult. Also, consider this person to be experienced, one who gives you the right kind of advice, as in Canada, the buyer is not required to pay any commission to the real estate agent; it is only from the seller that your realtor gets paid. Hence, it is important that this person remains honest in his/her endeavours for your house hunting.

Even before you sign up with an agent, I suggest going and looking at open houses(use realtor.com or zolo.com to see house listings). You do not need an agent to see an open house. Open houses will help you identify what is the exact criteria for buying your dream house, some of which are listed below:

- Number of Bedrooms 3/4/5?

- Number of Washrooms 3/4/5?

- Basement finished or unfinished?

- If the basement is finished, is it a legal basement or not?

- Age of the house: Old houses will have higher maintenance costs.

- Nearby schools and their ratings if you have small children.

- Neighbourhood and community

- Grocery stores, banks and other important stores nearby

- How far is the bus stop, subway station, or go station from the house?

- Transportation time to your workplace?

- Property Tax?

Once you like a house and it falls within your budget, what’s next?

Your realtor’s experience will now come into the picture as he/she may guide you with the best price of the house to make an offer. Some research is required based on the price of recently sold nearby houses, market trends and house condition. Once you both agree on one price, the realtor will build an offer document and send it to you to sign.

Things to take care of before you send an offer:

- Check to see if you want to make a conditional or firm offer.*

- Check for the initial deposit amount mentioned and whether you have the funds ready.

- Double check if the offered price in words and numerals match.

- Check all the dates, such as offer acceptance and deal closing dates.

*A conditional offer can have any condition, such as a time limit of 5 days, subject to mortgage approval, home inspection, or any other condition based on your findings. Check for inclusions mentioned in the offer price, such as appliances, fixtures, lights etc.

Sometimes in a few listings, there arises a bidding war, where you need to be physically present at the house on the day of the offer presentation. In such cases, you will be kept in a dark spot by the seller’s agent at that time and might be asked to increase your offer amount on the pretext that your offer could get accepted if it gets close to the seller’s expectations. However, the seller’s agent is obliged to reply to you or your agent the same day regarding your offer.

Be prepared for some initial disappointments because the first few offers might get rejected due to various reasons such low price, firm offer, and conditional offer. Try your best to get a pre-approved mortgage, in which case you can give a firm offer with a very high possibility of getting it accepted.

Wish you all the best for house hunting.

Leave your questions in the comments section, will try to answer them as soon as I can.

Disclaimer: I wrote this blog from my personal experience, research and findings, and it’s also not legal advice. I am not a licensed Real estate Agent/Broker. All information in the blog is just about sharing personal experiences. For updated information, kindly seek your licensed real estate agent/broker or mortgage agent/broker. Some of the details in the blog might not be updated as per current rules, regulations, and guidelines, so kindly seek advice from your respective licensed real estate or mortgage agent/broker.